As tax season approaches, homeowners and property managers find themselves contemplating how to best utilize their tax returns. While vacations and splurges are tempting, there’s a more practical and valuable option: investing in your home. Sam Boak, the president and founder of Boak & Sons, Inc., shares his wisdom on why directing your tax returns toward home improvements, specifically your roof, is a smart move.

The Value of Home Improvements

Sam Boak has been a long-time investor with multiple real estate properties. His experience extends beyond the business realm; he actively encourages his employees to seek financial counseling when needed. With tax returns starting to hit bank accounts, he hopes to inspire both customers and employees to make wise investments in their homes and commercial buildings.

Why Your Roof Matters

1. Increase Property Value

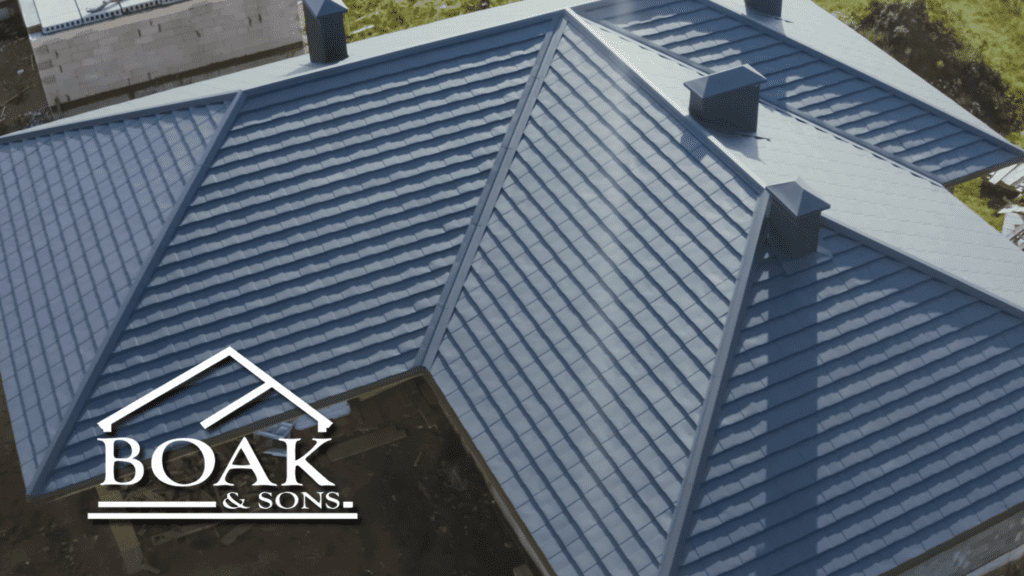

Putting your tax returns toward a project such as new siding, insulation, or roof repair can pay for itself in value. Not only will you enhance your property’s aesthetics, but you’ll also boost its overall worth. A well-maintained roof is a key factor in determining a home’s value.

2. Long-Term Savings

Investing in your roof isn’t just about aesthetics—it’s also about practicality. By repairing or upgrading your roof, you can lower future expenses, such as heating and cooling costs. A well-insulated and weather-resistant roof ensures energy efficiency, which translates to savings over time.

The Numbers

According to Yahoo Finance, the average tax return in Ohio in 2020 totaled $2,510, while in Pennsylvania, it was $2,623. These returns can cover a significant portion of services provided by Boak & Sons, including roofing and insulation. Even if you’re not in their service area, Sam Boak’s advice holds true: investing in your property pays off.

Take Advantage of Tax Season

COVID-19 has kept many people at home, giving us ample time to assess necessary projects. Tax season has always been a popular time for scheduling home improvements, and it’s even more relevant after the pandemic. Whether you’re a homeowner or a business owner, consider using your tax returns to make essential improvements to your property.

Remember Sam Boak’s advice: “There are multiple opportunities available to homeowners and building managers to put their tax returns towards improving the value of their properties.” Using that money for projects like a new roof or siding will pay dividends in the long run.

About the Author: Sam Boak is the president and founder of Boak & Sons, Inc., an exterior contracting company specializing in residential and commercial roofing, insulation, siding, gutters, and sheet metal services.

Disclaimer: This blog post is for informational purposes only and does not constitute financial or tax advice. Always consult with a professional before making any financial decisions.

- Alexis Cox

- Marketing Director